Optionstrategist – The Expected Return Calculator

$249.00 Original price was: $249.00.$58.00Current price is: $58.00.

Click the “Summary” tab and outputs are calculated swiftly and accurately, and all can be printed and exported to Excel. Tabular outputs include position “greeks” as well as expected profit calculations at any number of user-defined dates during the life of the position.

Description

Accelerate your learning with the Optionstrategist - The Expected Return Calculator course, priced at just $249.00 Original price was: $249.00.$58.00Current price is: $58.00. on ESYSGB.com! Explore our extensive catalog of over 60,000 downloadable digital courses across Forex – Trading. Experience flexible, self-paced learning from experts and save over 80%. Empower your future today!

Click the “Summary” tab and outputs are calculated swiftly and accurately, and all can be printed and exported to Excel. Tabular outputs include position “greeks” as well as expected profit calculations at any number of user-defined dates during the life of the position.

Purchase Optionstrategist – The Expected Return Calculator courses at here with PRICE $249 $58

DOWNLOAD INSTANTLY

PLEASE CHECK ALL CONTENTS OF THE COURSE BELOW!

![Optionstrategist - The Expected Return Calculator - eSys[GroupBuy] The Expected Return Calculator](https://imcarea.com/wp-content/uploads/2017/06/The-Expected-Return-Calculator-300x295.png) The Expected Return Calculator

The Expected Return Calculator

Get The Expected Return Calculator at the CourseAvai

The Expected Return Calculator

$249.00

Use statistical analysis to evaluate potential positions

The Expected Return Calculator is McMillan’s proprietary analytical software that uses statistical analysis to evaluate complex option positions, in order to give the trader an idea of whether or not there is a probability of success in a trade.

What is Expected Return?

Expected Return is the return one could expect to make from a position over a large number of trials. Unfortunately, in the real world, each position we invest in has only one result – not a large number of results that we can average.

However, in the long run, if one consistently invests in positions with superior expected returns, then he should show superior returns in his portfolio or trading account. All the facets of a strategy are incorporated into expected return – in particular, the probabilities of making or losing money and the size of profits or losses are both factored in.

Why use the Expected Return Calculator?

The results from The Expected Return Calculator can easily help investors and traders decide whether a particular option position is worth establishing. Furthermore, expected return analysis is the only way that a trader can accurately compare different strategies to see which is best: is a diagonal spread or a covered write the best trade? Or maybe a simple option purchase is best. Expected return can help you decide.

Get The Expected Return Calculator at the CourseAvai

How to use The Expected Return Calculator

First, the trader defines his position, which can be extremely complex – involving multiple options and expiration dates, as well as a possible linear volatility skew.

![Optionstrategist - The Expected Return Calculator - eSys[GroupBuy] The Expected Return Calculator: Position Editor](https://www.optionstrategist.com/sites/default/files/expcalc1.png)

- Name the position for your own reference.

- Enter the specific dates you would like to use for your position’s “Evaluation Points” along with the starting date.

- Provide information about the underlying security, including the Symbol, Price, and Historical Volatility.

- Enter any dividend or volatility skew information that pertains to the position you are analyzing.

- Enter the information for each leg of the option position, including Option Symbol, Type (put or call), Quantity, Expiration, Strike Price, Option Price, and Option Implied Volatility (implied volatility can be set to 0 and be automatically calculated).

- Multiple underlying can be incorporated into the position as well by use of the “Add Underlying” button.

Click the “Summary” tab and outputs are calculated swiftly and accurately, and all can be printed and exported to Excel. Tabular outputs include position “greeks” as well as expected profit calculations at any number of user-defined dates during the life of the position.

![Optionstrategist - The Expected Return Calculator - eSys[GroupBuy] The Expected Return Calculator: Summary](https://www.optionstrategist.com/sites/default/files/expcalc2.png)

- A summary of your inputs is provided.

- The Greeks, including Delta, Gamma, Theta, Vega and Rho are calculated and presented.

- The Expected Dollar Return is shown at each data point for each leg and the entire position.

- The Expected Percentage Return is provided for the entire position at each data point.

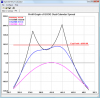

Under the “Plot” tab, graphical outputs show how the position is expected to behave at the user-defined intervals. The Expected Return calculator allows you to easily visualize exactly how much money you’d expect to make or lose at any underlying price and at any time throughout the life of the position.

![Optionstrategist - The Expected Return Calculator - eSys[GroupBuy] width=](https://www.optionstrategist.com/sites/default/files/imagecache/product_full/Expected_return_calc_screenshot3.png)

More about The Expected Return Calculator:

- Analyze complex positions involving multiple options

- Encompasses volatility skews

- Date Calculator functions

- Profit/Loss Graph, including user-defined time lines

- Expected profit clearly marked on profit graph

- Legend on profit graph allows easy identification of important data points

- Tabular display of profit information available as well

- Position “greeks“ are shown

- User-defined commission rates allowed

- Outputs can be exported to Excel

- Save data files to your hard drive

- Print functions available for all outputs – graphic or tabular

- 30-page User Manual included under Help Topics

Get The Expected Return Calculator at the CourseAvai

Purchase Optionstrategist – The Expected Return Calculator courses at here with PRICE $249 $58

Build a robust future with the Optionstrategist - The Expected Return Calculator course at ESYSGB.com! Gain lifetime access to high-impact digital content, meticulously designed to boost your career and personal growth.

- Lifetime Access: Permanent and unlimited access to your purchased courses.

- Exceptional Savings: Enjoy discounts of up to 80% off original prices.

- Secure Payments: Your transactions are fully protected and safe.

- Practical Knowledge: Acquire actionable skills for immediate application.

- Instant Availability: Start learning right after completing your purchase.

- Cross-Device Access: Study seamlessly on any desktop, tablet, or mobile device.

Unlock your potential with ESYSGB.com!

Related products

-

Multi Histogram Indicator for TOS – Simplertrading

0 out of 5(0)What could be better than seeing Squeeze Pro signals setting up on 18 timeframes? How about being able to tell at a glance if they are bullish or bearish? Now you can… Multi Histogram Indicator for TOS – Simplertrading

$397.00Original price was: $397.00.$55.00Current price is: $55.00. -

NJAT Trading Course

0 out of 5(0)It is the means by which individuals, companies and central banks convert one currency into another – if you have ever travelled abroad, then it is likely you have made a forex transaction… NJAT Trading Course

$27.00Original price was: $27.00.$11.00Current price is: $11.00. -

RSI ADR Dashboard Indicator

0 out of 5(0)The RSI / TDI alert dashboard allows you to monitor 6 main timeframes (selectable by you) at once on every major pair you trade. The dashboard will alert you to extended conditions (overbought and oversold) at levels of your choice when a candle closes on the chosen time frame. You can have 6 seperate RSI time frames monitored at once… RSI ADR Dashboard Indicator

$27.00Original price was: $27.00.$25.00Current price is: $25.00. -

Foundational Training – Clean Change”

0 out of 5(0)- This Course is available – Download immediately

- Same author: Clean Change

- Lifetime support – Unlimited downloads.

- The quality exactly the same as salepage

- Over +7000 Courses, AudioBooks, eBooks available.

$1,299.00Original price was: $1,299.00.$178.00Current price is: $178.00. -

Only 2% of Traders make money from Binary Options trading. I am sure many of you are aware of that. I am not here to provide u the holy grail of trading but Revealing My Latest Secret Never Losing Formula By Just Using 30 Minutes Per Day To Make Me Consistent Profits… Options Trade Secret: Triple Candy Method, 95% High Win Rate – Eden Koh

$89.99Original price was: $89.99.$25.00Current price is: $25.00. -

Fiebel – LPA Logical Price Action The Complete Course

0 out of 5(0)Due to the digital format of all our products and content, all sales and purchases on our site are final. Should you have any concerns about our refund policy, contact us at [email protected]… Fiebel – LPA Logical Price Action The Complete Course

$1,249.00Original price was: $1,249.00.$115.00Current price is: $115.00.

![Optionstrategist - The Expected Return Calculator - eSys[GroupBuy] Optionstrategist - The Expected Return Calculator](https://esysgb.com/wp-content/uploads/2023/04/9676_new.png)

![Optionstrategist - The Expected Return Calculator - eSys[GroupBuy] d12261f0b87e46c9b9eb64d75a347a4e - eSys[GroupBuy]](https://cdn.loom.com/images/originals/d12261f0b87e46c9b9eb64d75a347a4e.jpg?Expires=1615556328&Policy=eyJTdGF0ZW1lbnQiOlt7IlJlc291cmNlIjoiaHR0cHM6Ly9jZG4ubG9vbS5jb20vaW1hZ2VzL29yaWdpbmFscy9kMTIyNjFmMGI4N2U0NmM5YjllYjY0ZDc1YTM0N2E0ZS5qcGciLCJDb25kaXRpb24iOnsiRGF0ZUxlc3NUaGFuIjp7IkFXUzpFcG9jaFRpbWUiOjE2MTU1NTYzMjh9fX1dfQ__&Signature=AMzyribJos9jLUaazBNDZrcOzO37bPOYYTptLbVzJTHkSNVkwEnf0LIgiRUjEGlYDUbhHFpV0yMW9WqqdF4Wc7JIxjYvYFLM787pJF56ocv9~YjgScRpm9FCXkWUw3Mtssx1HGEBQp7BINjH2SYgUYvT0k3jWXQAweWXaIfl3Duof1-bMlnJG9eczkPyg08y8pPlD3zedOXtj301ehC9~iwJ0XKCS9huO0yef218a4pzN3Qcs3jA-0V6bBBxlFaTXZmb0B0GRbjnixNVrlrm44w-4a3OF6FEhxBPUCUuNq3ZiwPrIbFPiG1I3QPB6VtMk8DMfE0NpPbcbmqxDXSQ0w__&Key-Pair-Id=APKAJQIC5BGSW7XXK7FQ)

![Multi Histogram Indicator for TOS – Simplertrading - eSys[GroupBuy] Multi Histogram Indicator for TOS – Simplertrading](https://esysgb.com/wp-content/uploads/2021/08/Simplertrading-E28093-Multi-Histogram-Indicator-for-TOS.jpg)

![NJAT Trading Course - eSys[GroupBuy] NJAT Trading Course](https://esysgb.com/wp-content/uploads/2021/06/NJAT-Trading-Course.jpg)

![RSI ADR Dashboard Indicator - eSys[GroupBuy] RSI ADR Dashboard Indicator](https://esysgb.com/wp-content/uploads/2021/08/RSI-ADR-Dashboard-Indicator.jpg)

![Options Trade Secret: Triple Candy Method, 95% High Win Rate - Eden Koh - eSys[GroupBuy] Options Trade Secret: Triple Candy Method, 95% High Win Rate - Eden Koh](https://esysgb.com/wp-content/uploads/2021/08/Options-Trade-Secret-Triple-Candy-Method2C-95-High-Win-Rate.jpg)

![Fiebel - LPA Logical Price Action The Complete Course - eSys[GroupBuy] Fiebel - LPA Logical Price Action The Complete Course](https://esysgb.com/wp-content/uploads/2021/07/Fiebel-LPA-Logical-Price-Action-The-Complete-Course.jpg)